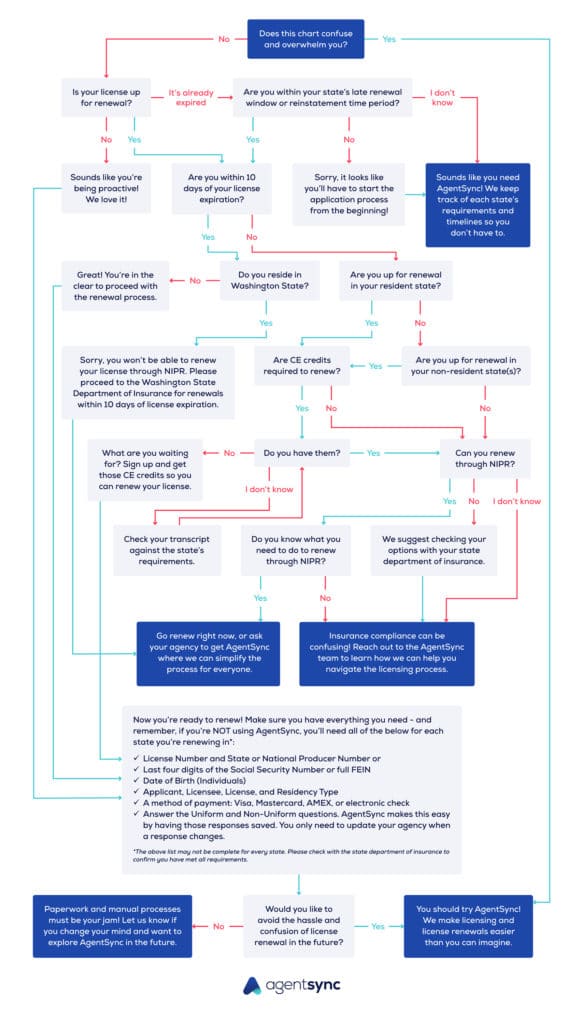

The frequency of your insurance license renewal varies from annually to every four years. For those licensed in only one or two states, this may not be difficult to manage. For those licensed in a large number of states, it can quickly become a logistical nightmare.

Some cycles of renewal are based on when you were licensed, others are based on when you were born. Others still are based on your license number, and some (like Hawaii) will renew in even or odd years, depending on if you were born in an even or odd month.

Not only do the number of years for which a license is valid vary by state, but, while most renewal deadlines are on the last day of a producer’s birth month, some states have specific rules such as renewing on your birth date, the last day of February (Delaware), or, in the case of California, the anniversary month of your first insurance license (which can get really interesting if you let your license lapse or hold multiple lines of authority). Talk about confusing!

NIPR is an amazing resource that helps simplify the producer licensing process. For the majority of licensed insurance agents and brokers, and for the majority of states and lines of authority, you’ll be able to renew your license online through NIPR.

But there are exceptions. This chart outlines what services NIPR provides on a state-by-state basis. In some states, you can’t get your initial license but you can renew it. Services also depend on whether you’re a resident or nonresident, whether you need a producer license or adjuster license, and sometimes varies based on what line of authority you have.

All in all, while NIPR is a valuable resource, you may find you have to go to the state department of insurance website for some of your needs.

Luckily for consumers, continuing education (CE) is a large part of the insurance licensing process. This requirement ensures licensed producers are knowledgeable about the products they sell, even as regulations change over time.

While the need for CE is a constant across the industry, factors like how much you need, how often you need it, and what topics have to be covered are quite variable. For the purpose of keeping an active license, CE credits have to be earned prior to the cutoff for license renewal, which again, can be based on several factors like the licensee’s date of birth.

Another factor to consider is, while most states’ CE deadlines are technically also the license renewal date, some states require proof of CE weeks or months beforehand, so you’ll want to bear in mind where your resident state stands before you begin the renewal process.

All states grant reciprocity for most CE credits. Some states have specific requirements for things like annuities and long-term care insurance that other states don’t have. It’s important to keep tabs on the specific requirements for each state you’re licensed in (don’t assume!) to avoid a last-minute unexpected CE crisis when you go to renew a nonresident license.

One rule that always holds true is that you have to be current with CE in your resident state before pursuing a license renewal in a nonresident state. Many states allow CE to be taken anywhere and still count toward your resident state requirements. To add an additional layer, if you’re a public adjuster in the states of New York and California, you’ll also be subject to those states’ own CE requirements regardless of what else you’ve already completed outside the state.

In most states, a license is renewable through NIPR up to the expiration date. In some states, you even get a bit more leniency with a “late renewal period” after your expiration date has passed. Other states are stricter, and once your license expires you’ll have to start the licensing process over from the start.

Just in case you’re thinking, “Oh well, that’s not so bad,” keep in mind that some states (we’re looking at you, Arizona) have extremely strict policies which, for example, make you wait a full year to apply for a license if you let yours expire. And in Washington State, even waiting until 10 days before your license expiration can create more headaches by eliminating the option to renew through NIPR.

All in all, it doesn’t pay to procrastinate!

Renewing your resident or nonresident insurance license is a process that varies state to state. Wouldn’t it be great if someone would compile a complete guide that includes everything you need to know about each state’s insurance producer license process?

We did that! Check out our free 50 State Summary Table, or go even deeper with our (still free) Compliance Library. These resources can help you find the answers to all your burning California insurance license renewal questions, along with 49 other states.

Assuming you’ve got all of the above covered, a few final tips from NIPR include:

If you’ve read all this and think you’re in great shape for your next renewal, then hats off to you! We know keeping track of the ever-changing variables to keep multiple state producer licenses valid is no easy task.

The good news is that there are a growing number of technology tools made to help licensed insurance producers avoid the headaches of licensing compliance. With requirements on timing, CE, tolerance for lateness, and more, varying from state to state, there’s no shame in getting some help to make sure you don’t get caught in one of these renewal hiccups.

To see how AgentSync can help your agency or business entity stay on top of CE and licensing renewals, schedule a demo today!

Disclaimer - AgentSync does not warrant to the completeness or accuracy of the information provided in this blog. You are responsible for ensuring the accuracy and totality of all representations, assumptions, information and data provided by AgentSync to you in this blog. The information in this blog should not be construed as legal, financial, or other professional advice, and AgentSync is not responsible for any harm you sustain by relying on the information provided herein. You acknowledge and agree that the use of this information is at your own risk. You should always consult with the applicable state and federal regulatory authority to confirm the accuracy of any of the information provided in this blog.